At the Fire Department’s open house last night, a common question was: If the vote fails, will the city propose a new, larger facility that could include a pool? It’s understandable why residents might think the city could try again, but considering the current funding sources, I don’t believe that option would be feasible.

Understanding Current Funding Sources

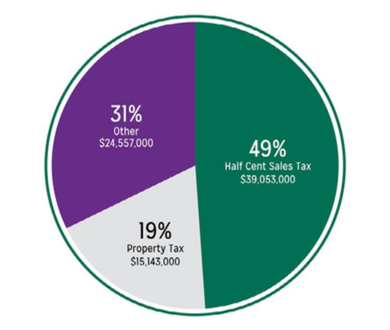

Let’s break down how the project is currently funded as we approach the November 8 vote. The proposed budget to build the facility is $79.9 million, and the funding comes from three main sources:

- $40M via a 1/2% Local Option Sales Tax: Approved by the state legislature in 2023, this sales tax is on the ballot because 2024 is the earliest year voters could authorize it. The tax would fund $40 million over 20 years, and once the debt is repaid, the sales tax would expire.

- $24.6M via Other Sources: This includes proceeds from selling the current rec center, naming rights, sponsorships, and property taxes generated by the Avienda Development, which will be allocated to repaying bonds on the new Community Center.

- $15.2M via Property Tax Increases: Property tax increases would be phased in over time. For a home valued at $600,000, the estimated tax increase would average about $17 per month over 20 years.

The State’s Role in the Use of a Local Sales Tax

Based on recommendations from the Parks and Rec task force, the city sought state approval to hold this referendum. Because the state collects sales tax, legislative approval was necessary. In 2023, the legislature approved the referendum as part of the omnibus tax bill but placed a moratorium on new local sales tax proposals until 2025 for all cities.

Since then, the state has formed a Local Taxes Advisory Task Force to review how local sales taxes are used to fund projects like this. The task force will establish new requirements and guidelines, which cities must follow starting in 2025. As of now, we don’t know what those requirements will be or whether a similar project would qualify for approval in the future.

Conclusion

The Chanhassen Bluffs Community Center proposal was only feasible because 50% of the funding would come from the local option sales tax. Without that funding, the $40 million would have to shift to property taxes, which would nearly triple the tax impact on residents. That’s something I cannot support.

Given the current circumstances, there is no “Plan B” if the vote fails.

If you have additional questions, let me know – josh@kimberforchanhassen.com.